Note: of May 31, 2021, the SBA has stopped the PPP application process.

As of January 1, 2022, they have stopped taking EIDL applications as well.

If you are still receiving letters/emails regarding pre-approved lines of credit for a PPP account

CLICK HERE

Have you recently received a letter from the SBA (Small Business Administration) regarding your Paycheck Protection Program “PPP”, or Economic Injury Disaster Loan “EIDL”? If you did and never applied for either one of these, you could be a victim of PPP or EIDL identity fraud.

Some people that received these letters figured it was junk mail and tossed it like any other spam letter, but it can be a warning sign that a fraudulent loan was taken out using your identity, either personal or business.

What are the PPP and EIDL?

The PPP, or Paycheck Protection Program, is a non-repayable, forgiveness loan that was created by the SBA to help business retain employees during the COVID crisis. As long as funds were used properly by the employer, the loan was to be forgiven.

The EIDL, or Economic Injury Disaster Loan, was created to help meet the financial needs of struggling businesses that were negatively impacted by the pandemic. The EIDL, unlike the PPP, must be repaid at some point; however, if certain criteria were met, the business could refinance the EIDL into a PPP and the loan could be forgiven.

-How opportunities were created for PPP and EIDL Fraud

While these programs were a crucial lifeline for many small businesses during the crisis, they also presented a perfect opportunity for fraud. With over 1.2 million complaints of PPP fraud reported by the Small Business Administration, it is one of the worst cases of large scale fraud in recent history. The SBA made three fatal mistakes when rolling out these programs.

- The application processes for these loans were streamlined to expedite the approval process, resulting in a lack of fraud detection.

- Businesses were originally required to apply with their bank. To further streamline the approval process, the SBA announced that a business could apply with any financial institution, including virtual (online) banks.

- Because PPP loans are forgivable, credit checks were not required.

How did the criminals apply for these loans?

1. Applications under fake businesses

Unfortunately, due to all the different ways your information can be collected online, just about everybody’s name is waiting to be picked out of the hat when it comes to being a victim.

Since the dark web has more than enough databases full of identityfying information, criminals were easily able to fill out loan applications by creating a fictitious business and forging fake financial documents.

In many of the cases, the victim’s first or last name was used to create the fake businesses’ name, followed by “Farms” or “Inc”. (Smith Farms, James Inc)

Since the victim’s SSN was used, if the victim’s credit was good, the loan was likely approved, with the highest paying loan giving out $48,900 dollars.

As far as proof of ID, the bad guys applied online with the virtual banks. Most, if not all, require very little information or no information for proof of identity. If a driver’s license was required, bad guys could of easily make a fake one. The banks did not cross-reference any of the photo IDs to the state’s DMV database.

2. Applications under real businesses

Not all the applications were filed under fake businesses. A number of individuals discovered that their business identity was used to apply for a loan or multiple loans.

In many states, business records are available to the public. For example, in Florida, anyone can search for businesses registered to conduct business in the state by visiting www.sunbiz.org. The information listed for each business often includes the business address, officers, and FEIN, information required on the PPP and EIDL application.

If you want to learn more about just how easy it is for criminals to use your business for fraud, check out our main article where we go more in depth on the topic.

Warning signs to look for

The strongest indicator that your information was used for any kind of loan fraud, is a new, unrecognizable credit inquiry. In this instance, it would have appeared as a new line of credit opened by the SBA on your credit reports.

It’s possible you wouldn’t have been able to spot any immediate warning signs at all, as not all PPP loans required a credit check.

These loans defaulted on the discrepancy of the financial institution, so a PPP loan could have been filed without detection unless someone tried to file for one themselves.

If you DID see an inquiry from the SBA on your personal credit report, there was a good chance you’ve been a victim. The same goes for your business as well—it could have also shown up on the businesses credit report.

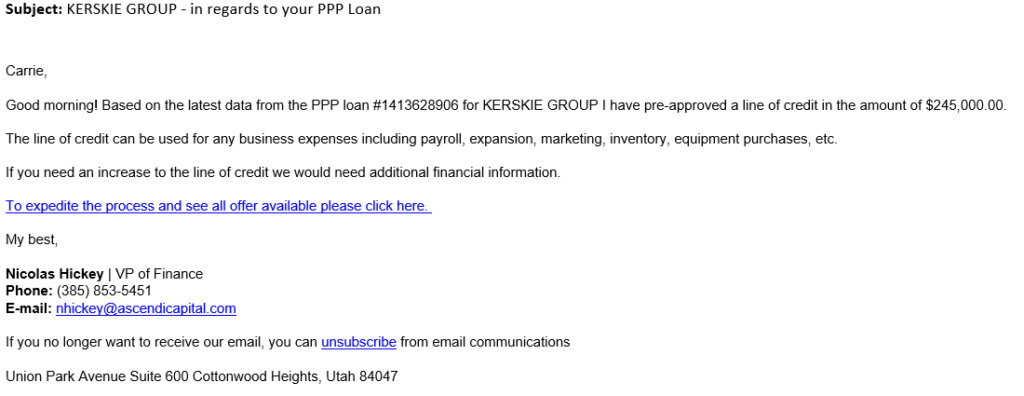

Fake PPP Email Scam

This scam has caused even more confusion on a topic that wasn’t so cut and dry already. It’s a phishing email taking advantage of the chaos sparked from all the PPP and EIDL loan fraud.

These emails do not indicate that a loan has been opened in you or your businesses name.

It’s not the most complex phishing email by any means, but it is certainly enough to elicit a reaction from people afraid of PPP fraud.

Businesses typically have emails that are publicly available anyways, so this scam is nothing but another attack sent out to the masses to try an get a few potential victims to click.

Steps to take if you believe you are a victim

If you received a letter from the SBA regarding a fraudulent PPP or EIDL loan, your best course of action is to contact the financial institute that approved the application and the SBA or visit the SBA and follow their instructions on reporting identity theft.

1. How to determine if someone took out a loan using your identity

If you’d like to see if your business was affected by PPP loan fraud, you can try searching this database that contains every company approved for a PPP loan.

What you’ll need to keep in mind though, is that these databases aren’t always reliable considering how many applications were filed under fake businesses.

2. Check your credit reports

By now (Late 2022), you or your business would have already experienced the fallout caused by a fraudulent PPP or EIDL application. However, it can’t hurt to check your credit reports to see if there are any suspicious accounts opened that you don’t recognize. If there was a fraudulent loan filed, it would show up as opened by the SBA.

Want to learn more?

Our blog is your one-stop-shop for all things related to identity theft and digital privacy protection. We provide you with the latest news and updates on identity theft trends and offer practical tips and resources to help you safeguard your personal information. We also cover a wide range of topics, from protecting your passwords and financial accounts to things like securing your social media profiles and online shopping habits.

Our team has over 15+ years of identity theft restoration and prevention experience, and we’ve created comprehensive guides and tutorials that will show you everything we’ve learned about detecting, preventing, and recovering from identity theft.

In addition, we offer reviews and comparisons of the top identity theft protection services, so you can find the best solution to fit your needs and budget.

Feel confident that you’re taking all the right steps to keep your privacy, finances, and devices protected. Don’t wait until it’s too late – join our community today!